|

||||

|

IN GOLD WE TRUST.

|

SWISSGOLD explains:

Why is gold valuable?

Read here a brief overview of the asset gold and what makes it so special.

Gold has a history

The oldest "gold coin" found in the world dates back to the 6th century BC. Gold has thus been valued and used as a means of payment for thousands of years. It has a long history as a symbol of wealth and has been used as a store of value, making it a trusted and established asset.

Gold is durable

Gold does not corrode, does not tarnish, and is highly resistant to damage and wear, making it an attractive option for jewelry, coins, and other items that need to last a long time.

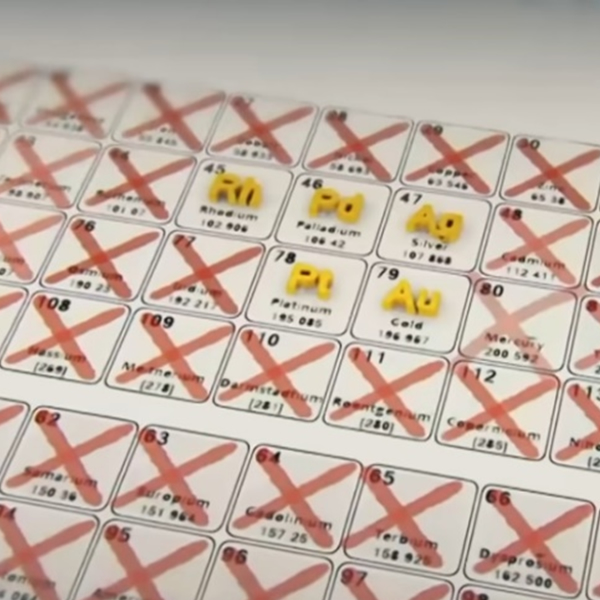

Only five elements on the periodic table are considered precious metals that are stable and long-lasting. These include gold, silver, platinum, palladium and rhodium, with gold being the most important as a carrier of value.

Gold is scarce

Gold is a rare metal that occurs in limited quantities, which contributes to its value. The limited supply and demand for gold contribute to its high price.

In total, about 210'000 tons of gold have been mined to date. About 3'700 tons of gold come onto the market each year (this figure includes recycled scrap gold). This corresponds to a value of about 228 billion dollars per year or not even 1 billion per day.

Gold is precious

Due to its scarcity, gold was and is a valuable asset and has been considered a symbol of wealth, power and success throughout history.

Unlike banknotes issued by central banks or crypto currencies created by a private collective or service providers, gold does not require a counterparty. Gold is not a debt and its value does not need to be guaranteed by anyone. Gold has therefore often been referred to as "God's" money.

Gold is used as collateral

Central banks and other institutions, as well as many private individuals, hold gold as collateral and part of their reserves. Gold is considered a safe haven and serves as a hedge against inflation and currency fluctuations in times of economic instability. Gold can also be used as collateral for loans and other financial transactions, as gold can always be liquidated and find a buyer in the market.

Gold is a physical asset

Gold is sold in the form of gold coins and gold bars in different sizes, from 1 gram to the standard bar of 400 ounces (approx. 12.4 kg). Depending on the size of the bar a premium on the actual gold value is charged. For small bars, this is much higher than for large bars, as they are more expensive to produce and handle

Gold as a dense metal is very heavy for its size. Buying, selling, transporting or storing gold usually involves physical handling and is therefore expensive.

Gold as digital real value

Physical gold, securely stored and linked to a digital proof of ownership via the serial number of the respective bar, can be handled flexibly.

The proof of ownership can be held for long-term wealth accumulation or transferred as required. The gold bars are stored securely in a high-security warehouse and do not have to be physically moved.

If you wish to receive the bars, the proof of ownership can be used to redeem the respective deposited bars for physical delivery.

Would you like to learn more about SWISSGOLD?

You can find more information on our website.

|

© 2021–2025 SWISSGOLD |

|